Public lecture

Public Lecture Activities for Tax Practitioners Undergraduate Accounting Study Program – Faculty of Economics and Business, Udayana University

The general lecture on taxation of the Bachelor of Accounting Study Program – Faculty of Economics and Business, Udayana University was attended by lecturers and students of S1 Accounting. The purpose of the General Lecture is for the academic community to have knowledge and skills in integrating knowledge between science and practice in the business world.

The General Lecture material was delivered by Mr. Kadek Sumadi (a senior tax consultant in Bali). Certificates of competence that he has are State Certificate Brevet: Brevet - C, Number: 060/Kep-0071KPKPI/2003, January 2003; Indonesian Tax Consultant Development Consortium; and he is also a registered Accountant from the Minister of Finance Reg No 14520, March 1996. His professional experience is Auditor Staff at Public Accountant Drs. Ketut Muliartha, RM; Partner at BKD Consulting (Accounting and Finance Consultant); Manager of Tax Division at Public Accountant Paul Hadiwinata, Hidayat & Partners; Manager of Tax Division at Public Accountant Tasnim Ali Widjanarko & Partners; Managing Partner of Tax Consulting Firm - SWS Consulting; Tax Lecturer; Department of Accounting, Faculty of Economics, Udayana University, Denpasar, Bali; Lawyer at Budi Adnyana Sumadi & Associates Law Office; Lawyer at Sumadi Putrawan & Partners Law; and Tax Court attorney. His organizational experience is IAI; Chairman of the Regional Management of the Indonesian-Bali Regional Tax Consultant Association; Chairman of the Regional Management of the Indonesian-Bali Regional Tax Consultant Association; Indonesian Tax Consultant Association Supervisor; and the Head of the Education and Development Division of the Denpasar Peradi Management.

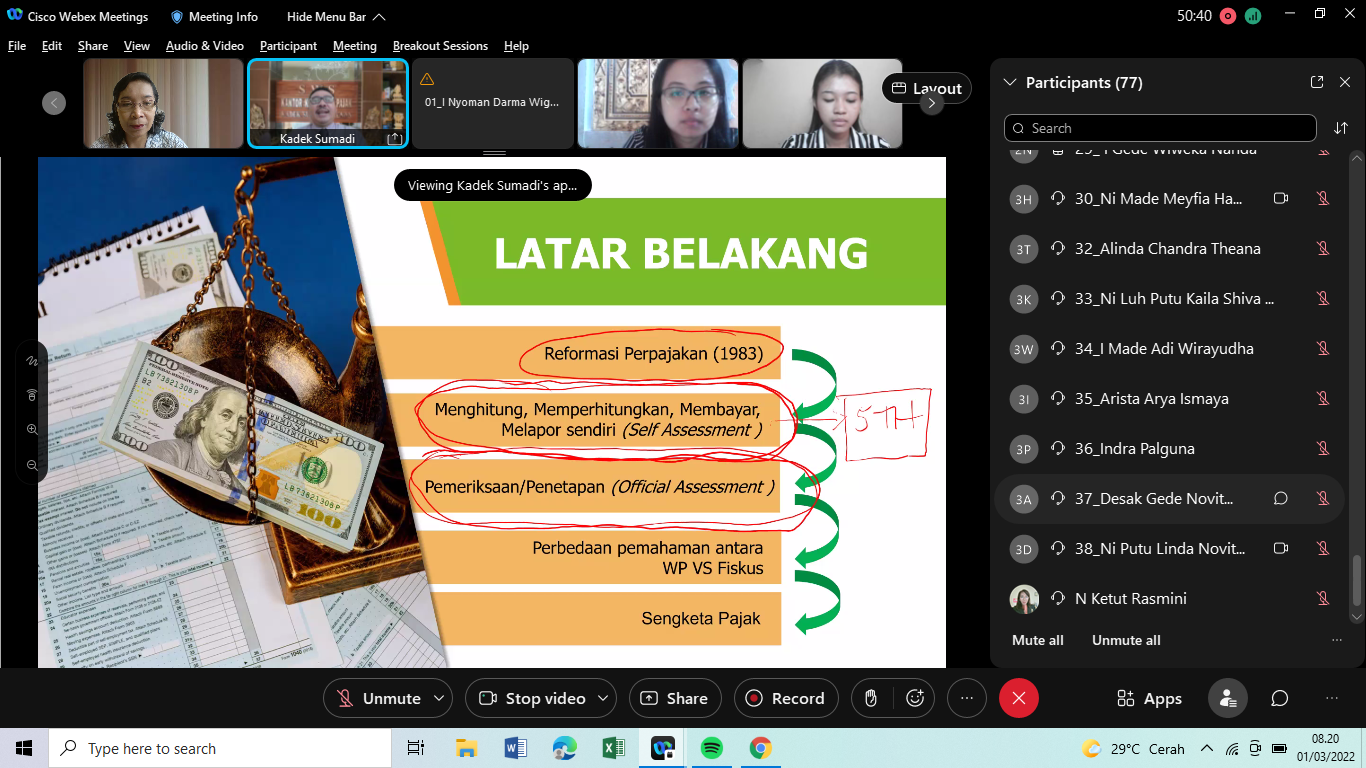

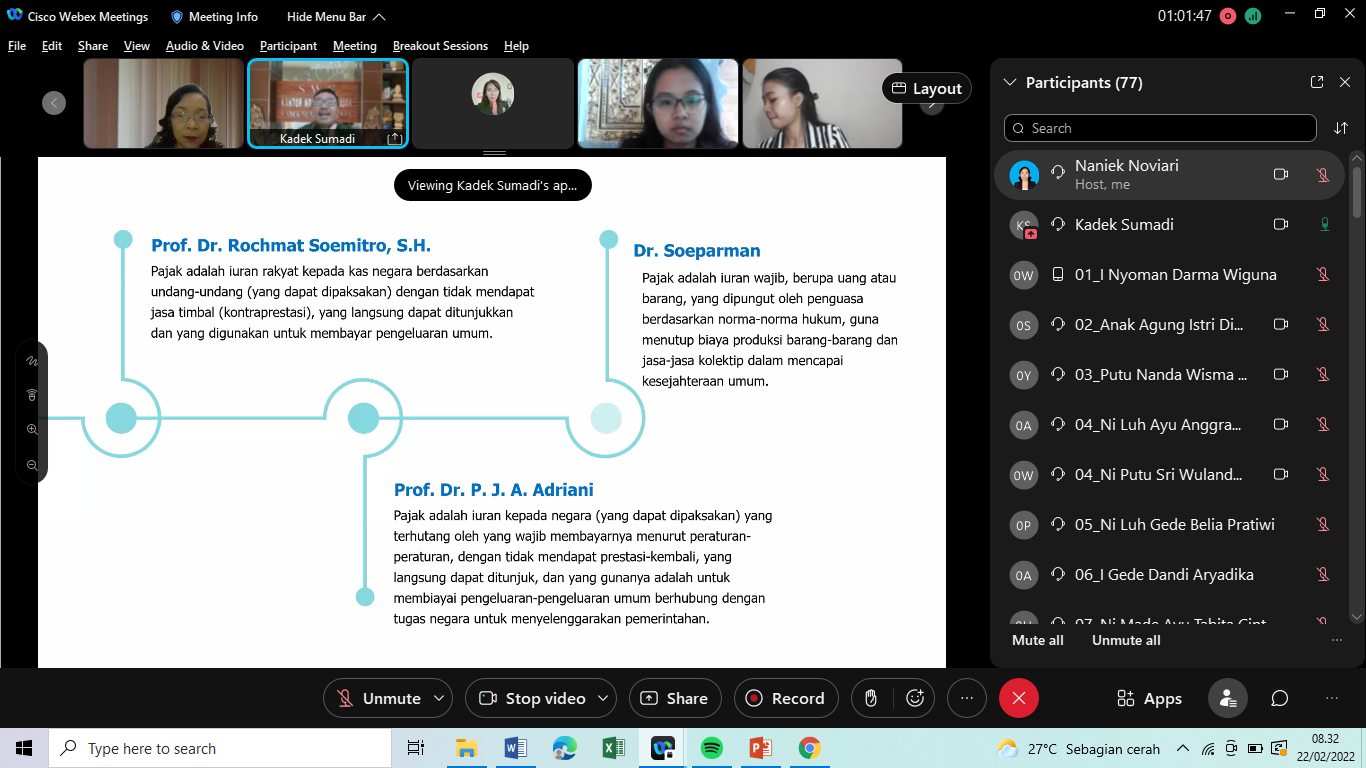

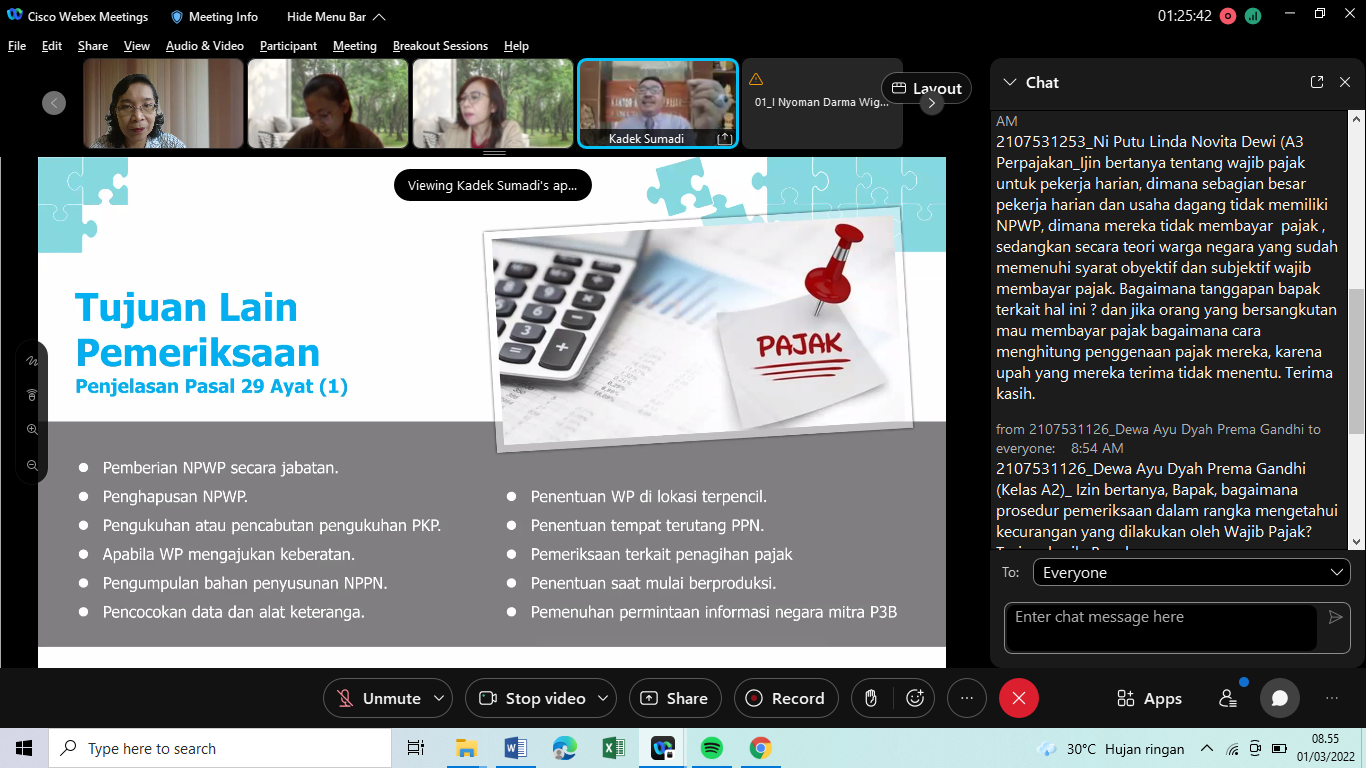

The material presented by Mr. Kadek Sumadi focused on the Basic Concept of Taxes – KUP as Formal Law/Procedures; Amendments to the KUP Law on the Job Creation Law; Amendments to the UU KUP/Creation of Work in the Law on the Harmonization of Tax Regulations; NPWP, Inauguration of PKP, & Payment of Taxes (Self Assessment); Tax Determination and Assessment (Official Assessment); Billing; Objections, and Appeals; Bookkeeping, Auditing & Special Provisions; and Criminal and Investigation Provisions. These materials are conveyed by being associated with practices that occur in the business world.

Students participating in public lectures were very enthusiastic about participating in the activities as evidenced by the many questions that were asked to the speakers. And because the resource persons answered questions in a language that students could easily understand, the discussion continued in a very warm and lively manner.

.jpg)

FACULTY OF ECONOMICS